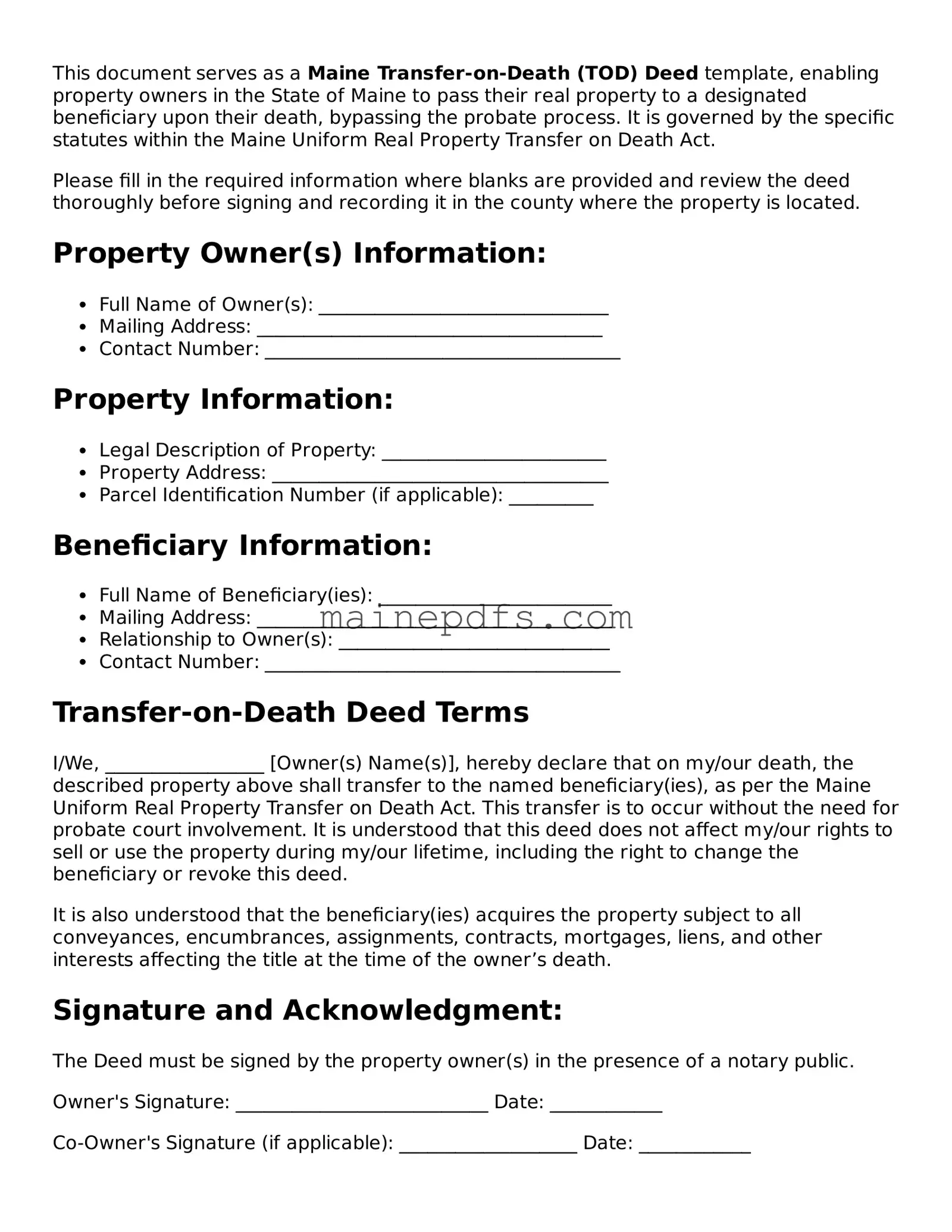

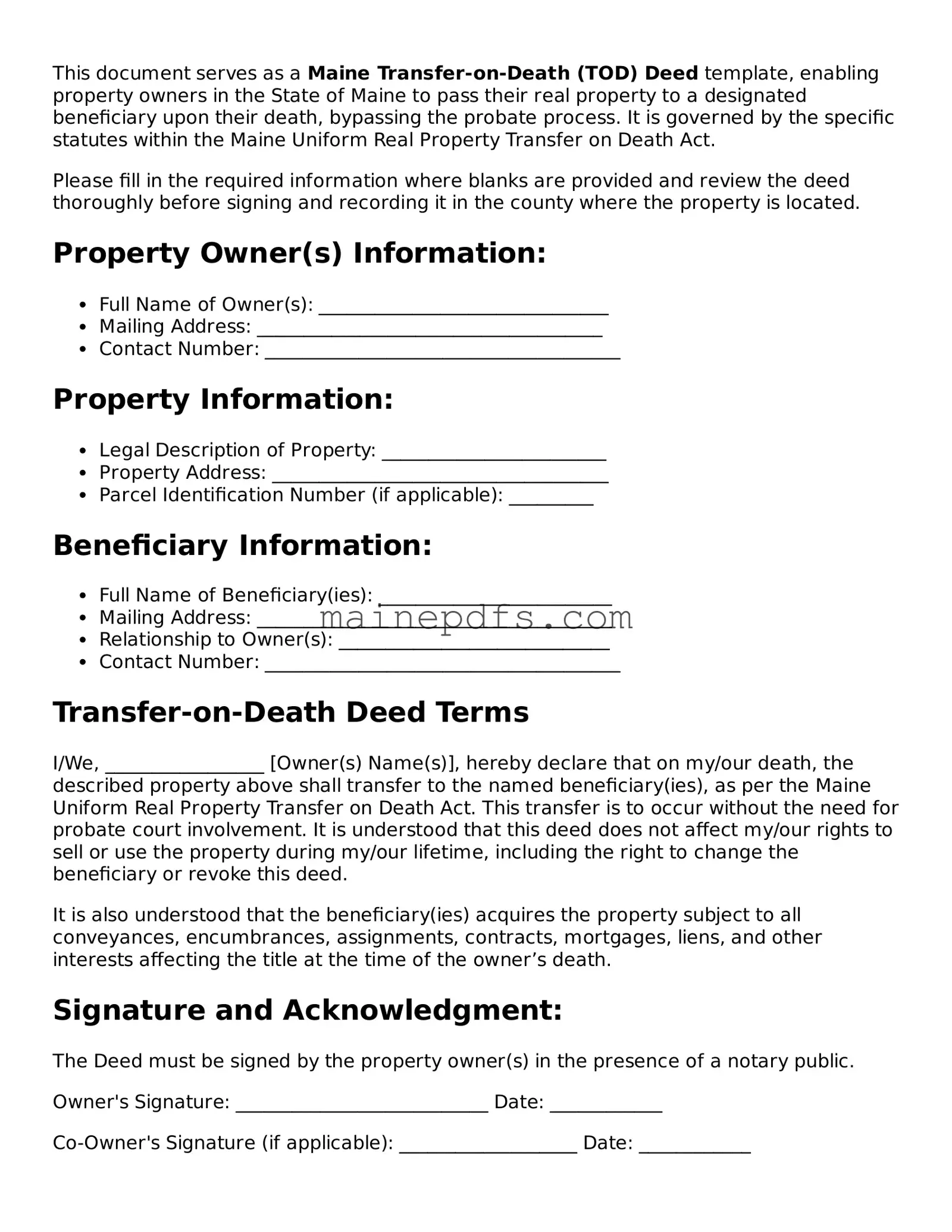

This document serves as a Maine Transfer-on-Death (TOD) Deed template, enabling property owners in the State of Maine to pass their real property to a designated beneficiary upon their death, bypassing the probate process. It is governed by the specific statutes within the Maine Uniform Real Property Transfer on Death Act.

Please fill in the required information where blanks are provided and review the deed thoroughly before signing and recording it in the county where the property is located.

Property Owner(s) Information:

- Full Name of Owner(s): _______________________________

- Mailing Address: _____________________________________

- Contact Number: ______________________________________

Property Information:

- Legal Description of Property: ________________________

- Property Address: ____________________________________

- Parcel Identification Number (if applicable): _________

Beneficiary Information:

- Full Name of Beneficiary(ies): _________________________

- Mailing Address: ______________________________________

- Relationship to Owner(s): _____________________________

- Contact Number: ______________________________________

Transfer-on-Death Deed Terms

I/We, _________________ [Owner(s) Name(s)], hereby declare that on my/our death, the described property above shall transfer to the named beneficiary(ies), as per the Maine Uniform Real Property Transfer on Death Act. This transfer is to occur without the need for probate court involvement. It is understood that this deed does not affect my/our rights to sell or use the property during my/our lifetime, including the right to change the beneficiary or revoke this deed.

It is also understood that the beneficiary(ies) acquires the property subject to all conveyances, encumbrances, assignments, contracts, mortgages, liens, and other interests affecting the title at the time of the owner’s death.

Signature and Acknowledgment:

The Deed must be signed by the property owner(s) in the presence of a notary public.

Owner's Signature: ___________________________ Date: ____________

Co-Owner's Signature (if applicable): ___________________ Date: ____________

State of Maine

County of _________________

Subscribed and sworn to (or affirmed) before me on this ___ day of __________, 20__, by _____________________ [name(s) of property owner(s)].

Notary Public Signature: ________________________

My commission expires: ___________

This document is intended for use in the State of Maine only and should be recorded with the local county registry of deeds office where the property is located, along with any applicable recording fees. Consultation with a legal professional is recommended to ensure compliance with current Maine laws and the proper execution of this deed.