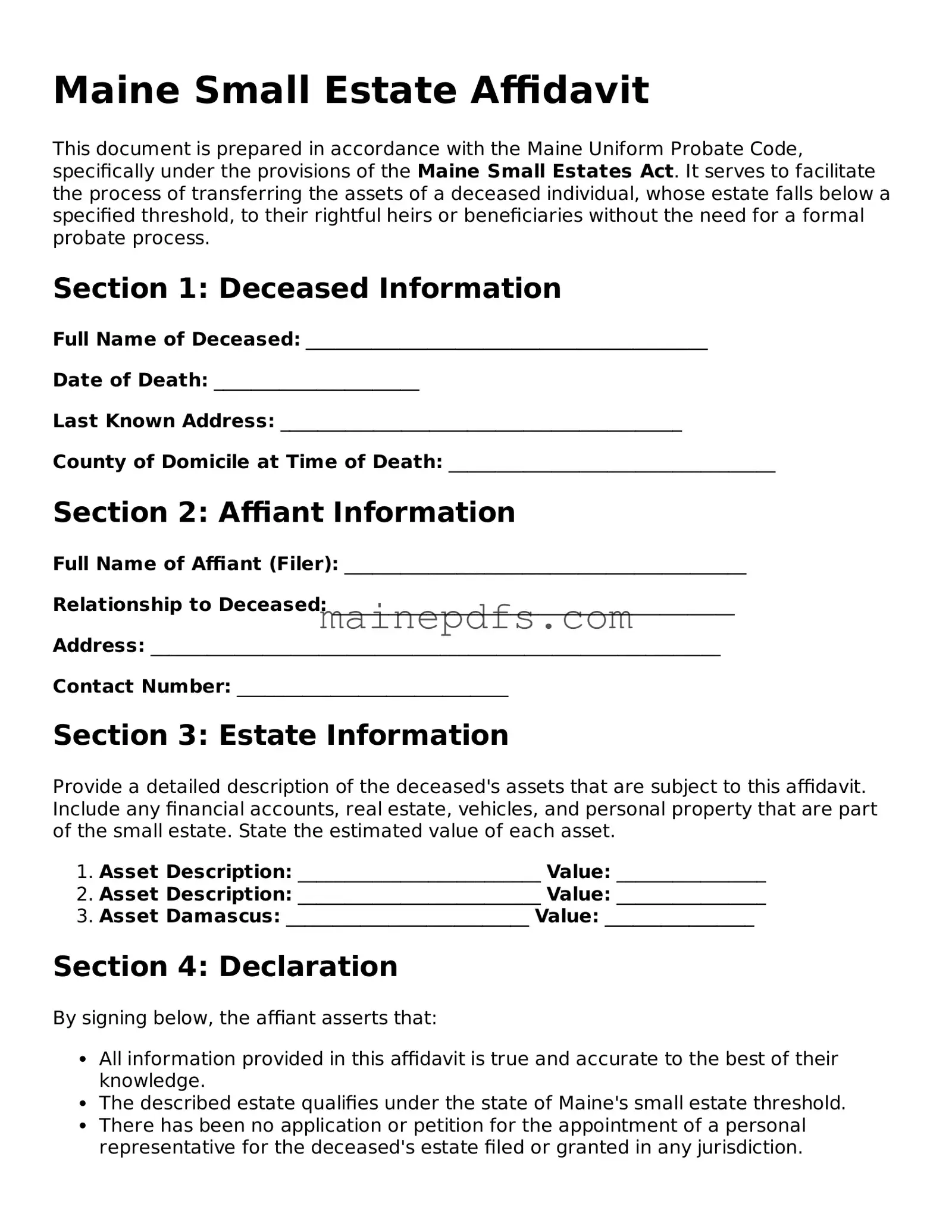

Maine Small Estate Affidavit

This document is prepared in accordance with the Maine Uniform Probate Code, specifically under the provisions of the Maine Small Estates Act. It serves to facilitate the process of transferring the assets of a deceased individual, whose estate falls below a specified threshold, to their rightful heirs or beneficiaries without the need for a formal probate process.

Section 1: Deceased Information

Full Name of Deceased: ___________________________________________

Date of Death: ______________________

Last Known Address: ___________________________________________

County of Domicile at Time of Death: ___________________________________

Section 2: Affiant Information

Full Name of Affiant (Filer): ___________________________________________

Relationship to Deceased: ___________________________________________

Address: _____________________________________________________________

Contact Number: _____________________________

Section 3: Estate Information

Provide a detailed description of the deceased's assets that are subject to this affidavit. Include any financial accounts, real estate, vehicles, and personal property that are part of the small estate. State the estimated value of each asset.

- Asset Description: __________________________ Value: ________________

- Asset Description: __________________________ Value: ________________

- Asset Damascus: __________________________ Value: ________________

Section 4: Declaration

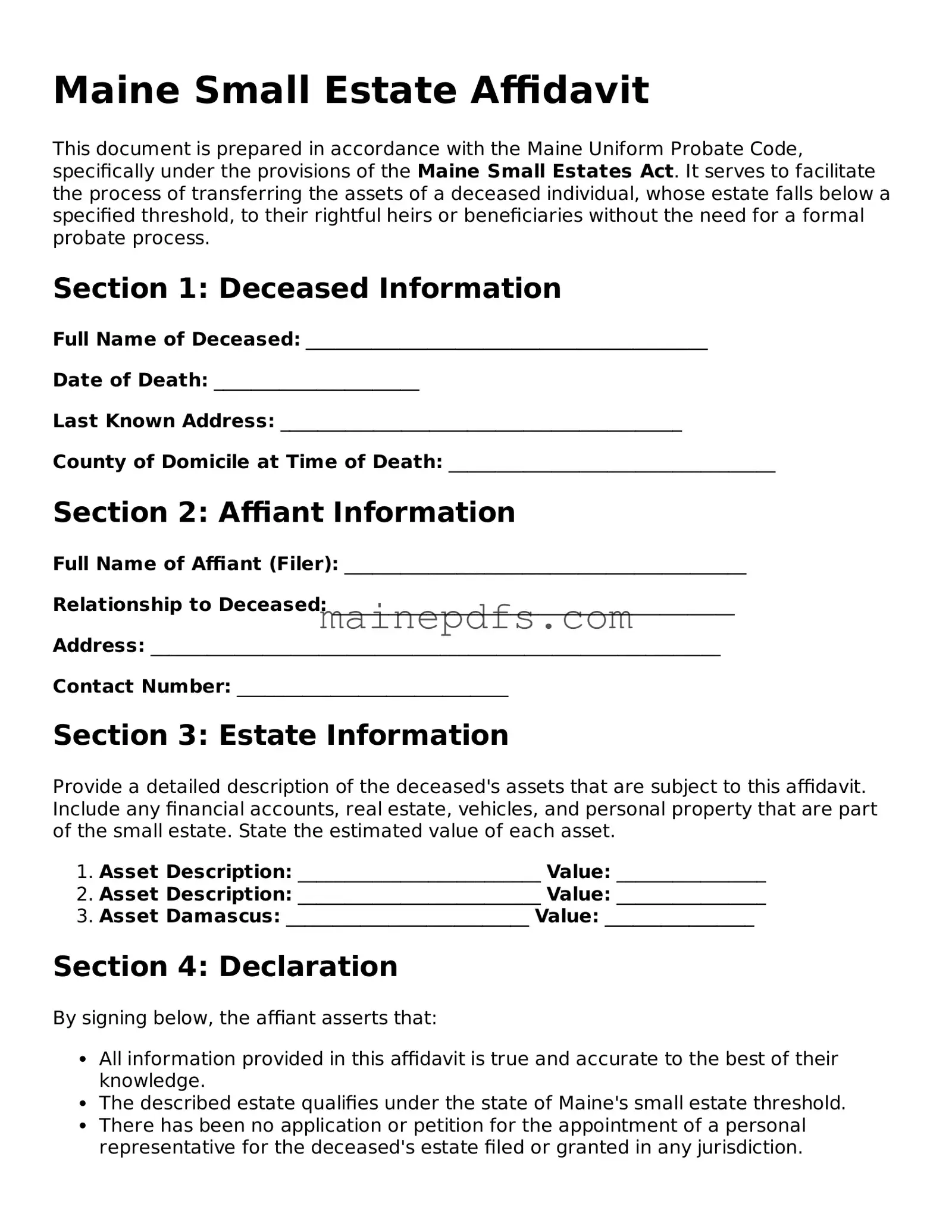

By signing below, the affiant asserts that:

- All information provided in this affidavit is true and accurate to the best of their knowledge.

- The described estate qualifies under the state of Maine's small estate threshold.

- There has been no application or petition for the appointment of a personal representative for the deceased's estate filed or granted in any jurisdiction.

- All debts, including funeral and burial expenses, taxes, and valid claims against the estate, will be paid or have been paid.

In witness whereof, the affiant acknowledges this affidavit this ______ day of ________________, 20____.

Affiant's Signature: ___________________________________

Printed Name: __________________________________________

Notary Public Section

This section must be completed by a notary public to authenticate the identity of the affiant and to verify the affidavit's validity.

State of Maine

County of: _________________________

On this, the ______ day of ________________, 20____, before me, a notary public, personally appeared _______________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the foregoing affidavit, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary's Signature: ___________________________________

Printed Name: __________________________________________

Commission Expires: _________________________