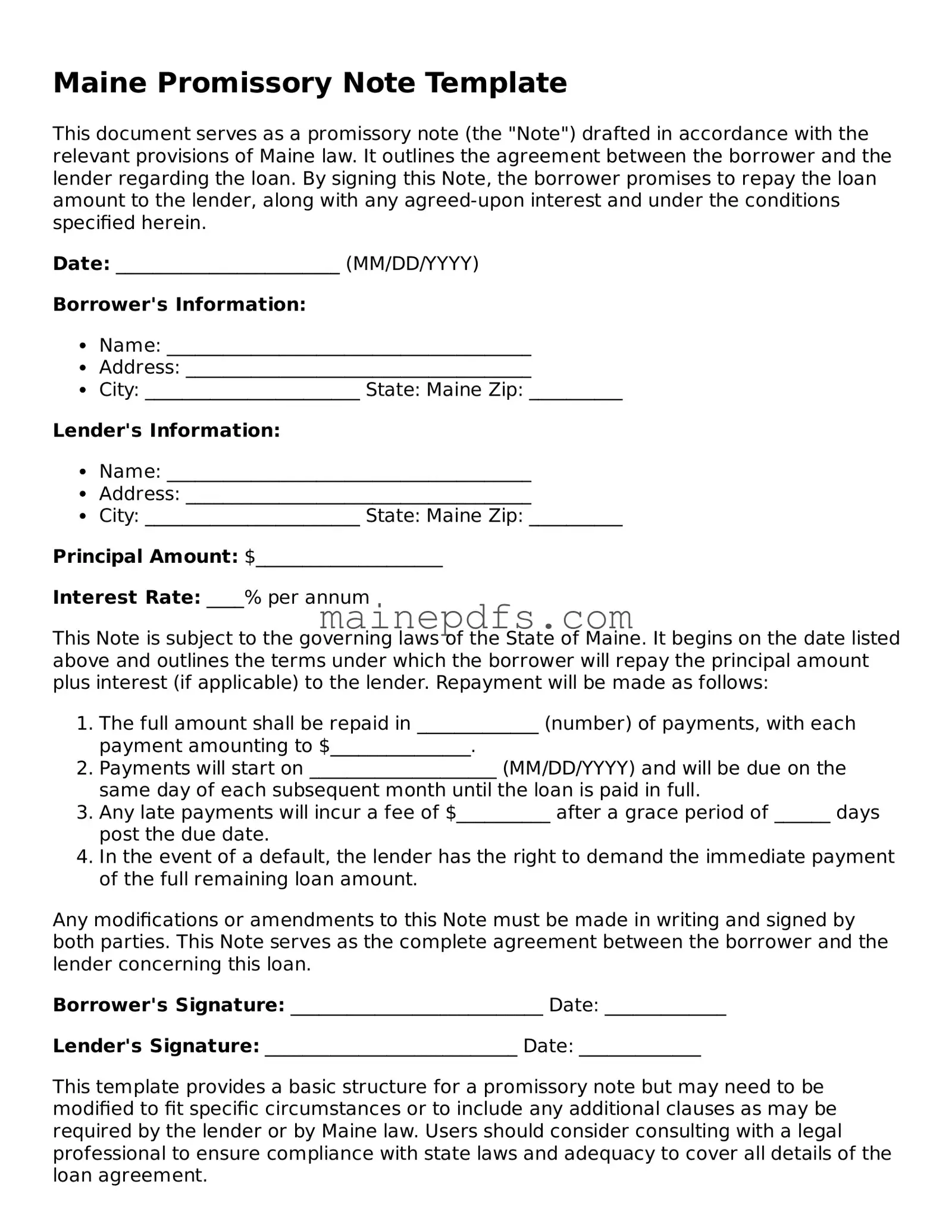

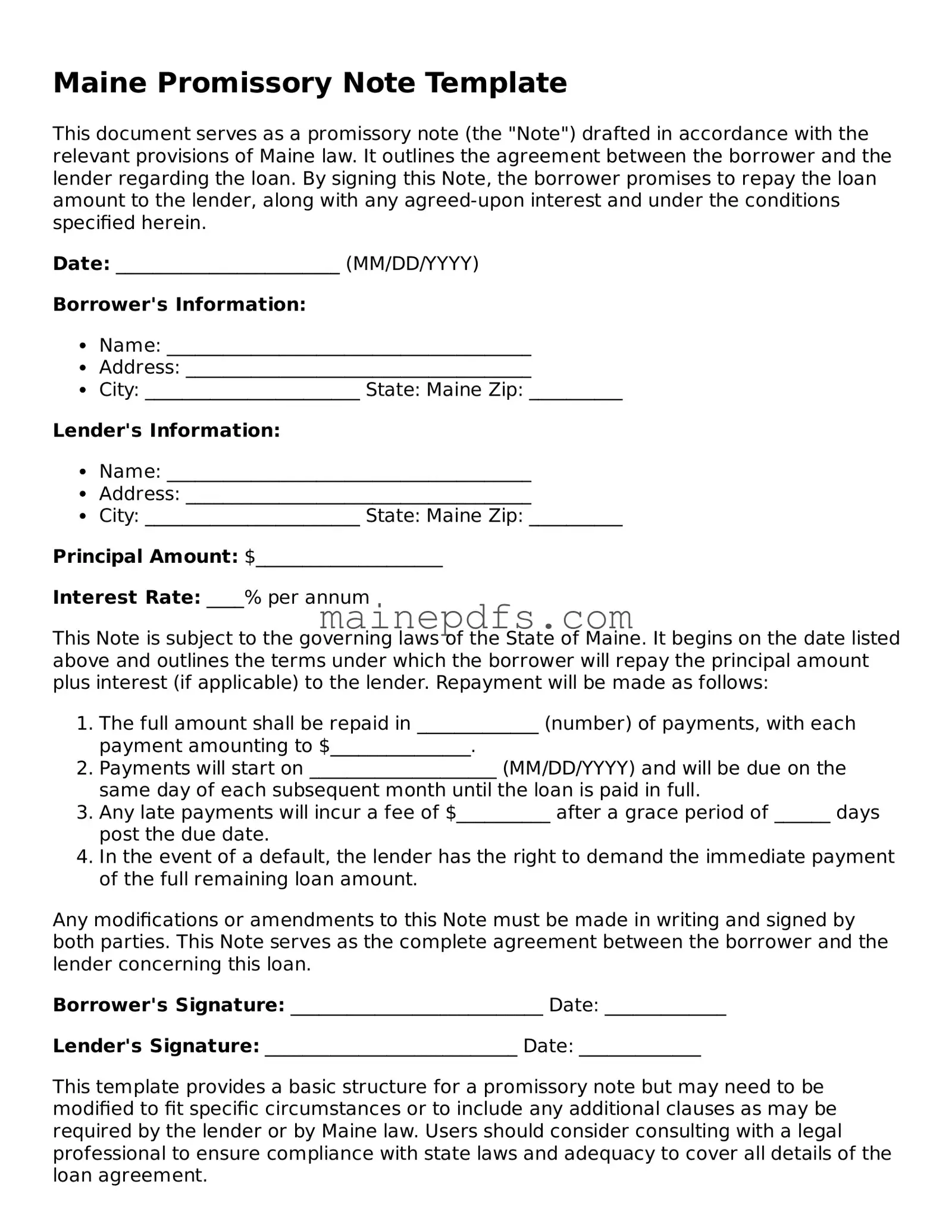

Attorney-Approved Maine Promissory Note Template

A promissory note in Maine serves as a legally binding document where one party promises to pay another a specified sum of money by a certain date. This document outlines repayment details such as the amount, interest rate, and payment schedule, making it crucial for financial transactions between individuals or entities. For those ready to secure their transaction with a Maine Promissory Note, a fully customizable form is just a click away.

Make My Document Online

Attorney-Approved Maine Promissory Note Template

Make My Document Online

Make My Document Online

or

Click for PDF Form

A few steps left to finish this form

Finish Promissory Note online — no paper, no scanner needed.