|

|

Maine Department of Health and Human Services |

|

Janet T. Mills |

Office of MaineCare Services |

|

Private Health Insurance Premium (PHIP) |

|

Governor |

|

11 State House Station |

|

|

|

|

Augusta, Maine 04333-0011 |

|

Jeanne M. Lambrew, Ph.D. |

Toll Free: (800) 977-6740; Fax: (207) 287-9385 |

|

Commissioner |

TTY: Dial 711 (Maine Relay) |

Private Health Insurance Premium Benefit

What is the MaineCare PHIP Benefit?

PHIP pays private health insurance premiums for MaineCare members who qualify. You must already have health insurance, or you must be able to get it. You may have health insurance through your job, or you may have an individual policy through an insurance company. MaineCare will not find health insurance for you.

How will the PHIP benefit help me?

MaineCare will pay part or all of the monthly cost of your health insurance plan. Having the

PHIP pay your private health insurance premium will not make you lose MaineCare.

If your child is enrolled in the Katie Beckett Program and you become eligible for the PHIP Program, your Katie Beckett premium may increase.

How does the premium get paid?

The PHIP Benefit Program will pay you (the policyholder) every month.

Can I have MaineCare and private health insurance at the same time?

Yes, even if you have private health insurance, you can qualify for MaineCare. PHIP is only for people who have MaineCare and private health insurance.

How do I find out if the PHIP benefit can pay my insurance premium?

We will need the following information to see if you are eligible for PHIP:

•Employer and Insurance Information form, enclosed with this application.

•Proof of the cost of your premium on a current pay stub or a current bill.

•The rates for the insurance to include the breakdown of cost for Employee,

Employee/Spouse, Employee/Child, and Family. This should be given to you during the open enrollment period and should be attainable through your employer’s Human

Resources Department.

•The annual open enrollment period dates and the effective date of the benefit period.

•The section of your benefit summary that includes your individual deductible amount.

•A copy of your medical and pharmacy insurance card, front and back.

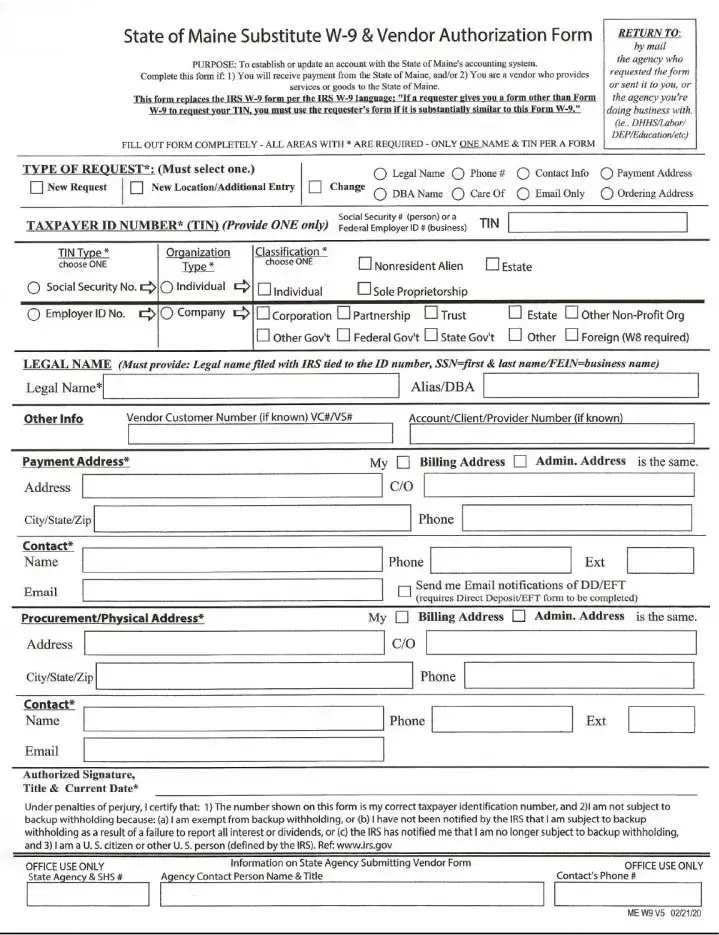

•W-9 form, completed by the policyholder in order to reimburse you your monthly premiums.

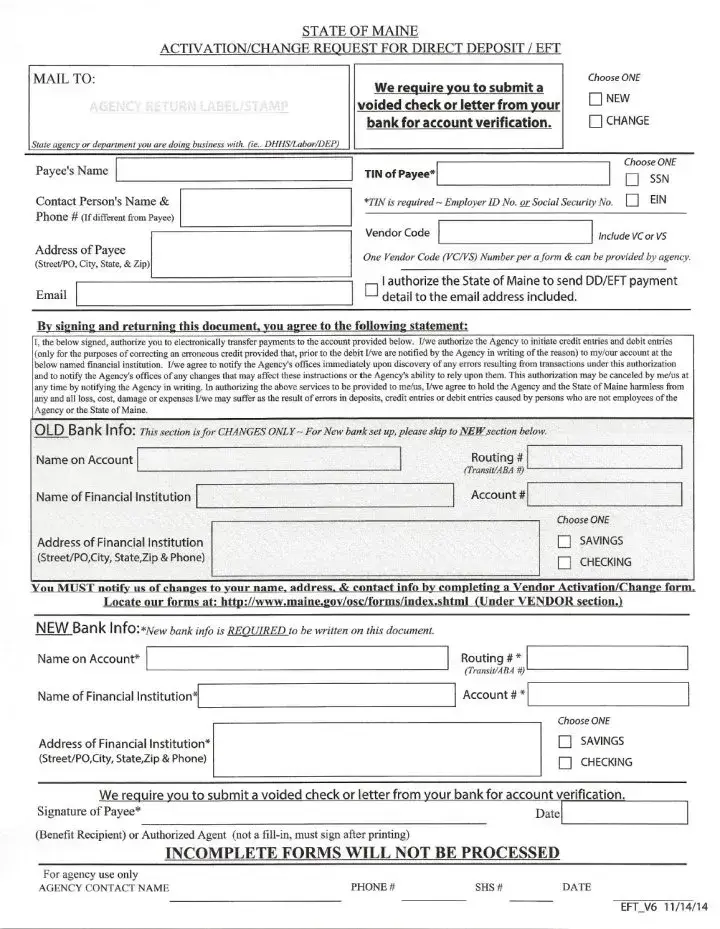

•A completed Direct Deposit Form.

•A voided check or letter from your bank on their letterhead providing their routing number, your name, address, account number and must indicate if it is a savings or checking account. We do not accept deposit slips or a starter check.

How do I complete the PHIP application?

Directions for filling out the PHIP application:

•Employer and Insurance Information Form: Please fill in all requested information on the form. Be sure you list the amount you pay for your policy and, if it is an employer plan, how often money is deducted from your paycheck. Please also note when open enrollment is so we know when to expect your costs to change. *We do not cover dental.

•W-9 Form: The policyholder of the health insurance should complete this form. Please fill in ONLY the policyholder’s name, address, social security number, signature and

date. This form is not used for tax reporting services. Our Accounting department needs it in order to send you checks.

•Direct Deposit Form: The policyholder must be on the checking or savings account. If you have a savings account that you want the check to go into, attach a letter from the bank with the account number, routing number, and name of account holder.

•MaineCare Participants Form: Please list the names, relationship to the policy holder; and MaineCare ID number and date of birth for each person. This form tells us who in the family is covered or will be covered by the private health insurance.

Please send the information to me by mail, email, or fax. We do not qualify you for prior months. If you have questions, please feel free to contact our office.

Sincerely,

Benefits Administrator 1-800-977-6740 Fax (207) 287-9385

|

|

EMPLOYER AND INSURANCE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee Social |

|

Employee Name: |

Security Number: |

|

|

|

|

|

|

|

|

|

|

Employee Address: |

Telephone Number: |

|

|

|

|

|

|

|

|

|

|

Employer Name: |

Contact Person: |

|

|

|

|

|

|

|

|

|

|

Employer Address: |

Telephone Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of open enrollment: ______ |

|

|

|

|

|

|

Medical Ins. Carrier Name: |

|

Medical Ins. Carrier Address: |

|

|

|

|

|

|

|

|

|

PLEASE ONLY SHOW HOW MUCH IS ACTUALLY BEING DEDUCTED FROM PAYCHECK

Single - Medical Employee w/Chrn - Medical Employee & Spouse

-Medical Family - Medical

Employee |

|

How Often Deducted |

|

Coverage (Please X |

Cost |

|

|

|

|

|

|

covered services) |

|

|

|

|

|

|

|

|

|

|

|

Weekly ↓ |

|

HMO, PPO |

|

|

Please circle 50 or 52 times/yr. |

|

Maj. Med/Comp. Plan |

|

|

Bi-Weekly ↓ |

|

Prescriptions |

|

|

|

|

|

Please circle 24 or 26 times/yr. |

|

Prescriptions Card |

|

|

|

|

|

Monthly |

|

Vision – Exam 1yrly |

|

|

|

|

|

|

|

Flexible Spending Acct |

|

|

Yearly |

|

HSA and/or HRA Acct |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medical Deductibles: |

|

|

|

|

Single: __________________ |

|

|

|

|

Family: |

|

|

|

|

|

|

|

|

|

Enrolled: Medical |

Y______ |

N______ |

|

|

|

Group # |

|

Certificate # _____________________ |

__________________________ |

|

|

|

|

|

|

MaineCare Member Information

Policyholder: _______________________________________________________

MaineCare ID# or DOB: ______________________________________________

Email Address: _____________________________________________________

MaineCare Member: _________________________________________________

MaineCare ID# or DOB: ______________________________________________

Relationship to Policyholder: __________________________________________

MaineCare Member: _________________________________________________

MaineCare ID# or DOB: ______________________________________________

Relationship to Policyholder: __________________________________________

MaineCare Member: _________________________________________________

MaineCare ID# or DOB: ______________________________________________

Relationship to Policyholder: __________________________________________

MaineCare Member: _________________________________________________

MaineCare ID# or DOB: ______________________________________________

Relationship to Policyholder: __________________________________________

MaineCare Member: _________________________________________________

MaineCare ID# or DOB: ______________________________________________

Relationship to Policyholder: __________________________________________

MaineCare Member: _________________________________________________

MaineCare ID# or DOB: ______________________________________________

Relationship to Policyholder: __________________________________________

MaineCare Member: _________________________________________________

MaineCare ID# or DOB: ______________________________________________

Relationship to Policyholder: __________________________________________