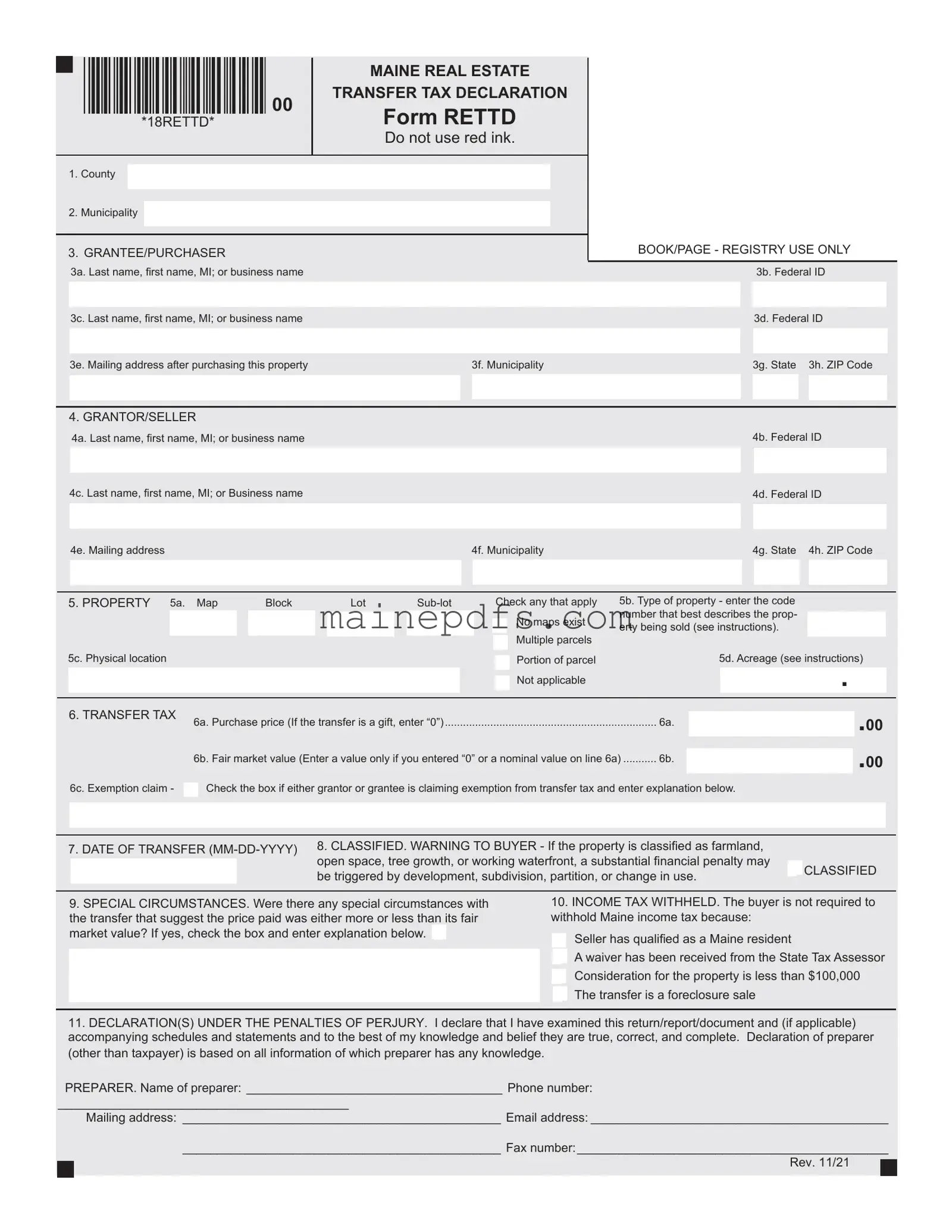

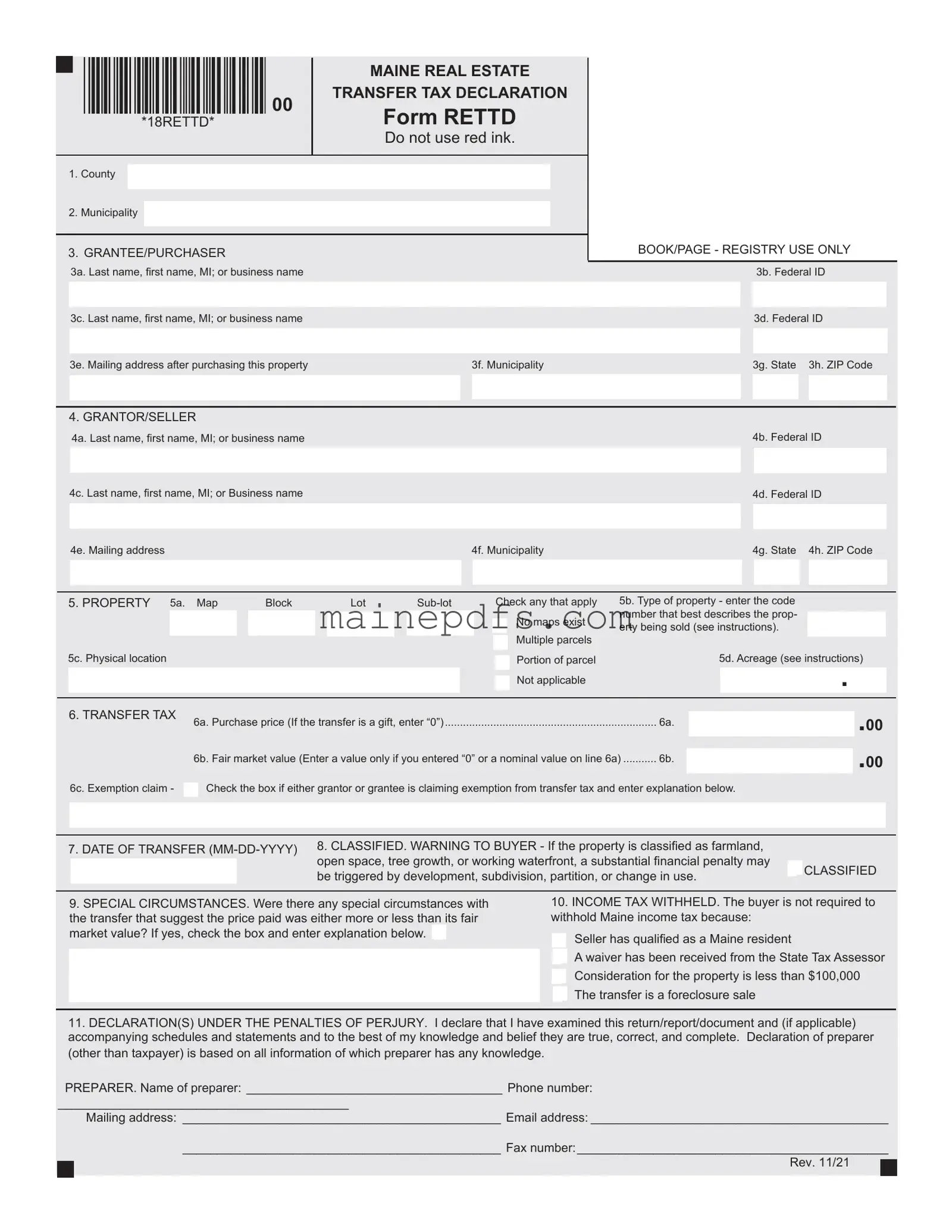

The Maine Real Estate Transfer Tax Declaration form (Form RETTD) shares similarities with other tax and declaration forms used across various jurisdictions and contexts in the United States. Each form, though tailored for specific transactions or tax requirements, encompasses structured sections for personal and property details, transaction-specific information, exemption claims, and a declaration under penalty of perjury.

One similar document is the Uniform Residential Loan Application used in the mortgage industry. Like the Maine Form RETTD, this application requires detailed information about the borrower (or grantee) and co-borrower, akin to the grantee/purchaser and grantor/seller sections. It includes property information and the financials of the transaction, paralleling the purchase price or fair market value reporting on the tax form. This document also necessitates a declaration or attestation by the applicants about the veracity of the information provided.

The Federal Estate Tax Return (Form 706) resembles the Maine tax form in its requirement for detailed disclosure of the decedent's property and transaction values, similar to the property and transfer tax details. Both documents serve as declarations with legal bindings, wherein the respective preparers must affirm the accuracy and completeness of the information under penalty of perjury.

State-specific Sales and Use Tax forms, which businesses must file, echo the RETTD's structure by necessitating detailed transaction information, seller and buyer details, and property descriptions if relevant. These forms also assess the transaction's tax implications based on the reported values, mirroring the purpose of the transfer tax determination in the Maine document.

The HUD-1 Settlement Statement, used in real estate transactions, shares a core similarity with the Maine Form RETTD in itemizing the financials of a property transfer, though it encompasses a broader range of transactional details and closing costs. Both documents categorize financial responsibilities between the parties involved and provide a comprehensive look at the property exchange's financial outcome.

The Internal Revenue Service's W-9 form, Request for Taxpayer Identification Number and Certification, although fundamentally a tax identification document, parallels the RETTD's sections that require the identification of parties through tax IDs. Such identification enables transparency and accountability in financial transactions, ensuring proper tax reporting and compliance.

Local zoning and land use permit applications can also be considered akin to the RETTD, especially in sections requiring detailed descriptions of the property. These documents often require applicants to describe the property's current and intended use, mirroring the RETTD’s requirement to specify the property type and details about its current classification and use.

The Agricultural Conservation Easement Program (ACEP) application, although more specific in its conservation focus, resembles the RETTD by requiring property descriptions, current use classification, and owner information. Both forms also include declarations by the individuals completing the forms, affirming the truthfulness of the information provided.

Lastly, the Declaration of Homestead forms, available in various states, require homeowners to provide specific property details, ownership information, and, often, the property's value. These forms, much like the Maine tax form, are filed with local government entities and serve as formal declarations with legal implications regarding the property's status and the owner's rights.

Check the box if either grantor or grantee is claiming exemption from transfer tax and enter explanation below.

Check the box if either grantor or grantee is claiming exemption from transfer tax and enter explanation below.

Seller has qualified as a Maine resident

Seller has qualified as a Maine resident A waiver has been received from the State Tax Assessor

A waiver has been received from the State Tax Assessor Consideration for the property is less than $

Consideration for the property is less than $ The transfer is a foreclosure sale

The transfer is a foreclosure sale