The Residential Lease Agreement shares similarities with the Maine Sale Agreement, particularly in the specification of parties involved, property description, and conditions of use or occupancy. However, instead of transferring property ownership, a lease agreement grants the lesit's rights to use and occupy rental property for a specified term under agreed conditions, highlighting the role of landlord and tenant rather than buyer and seller.

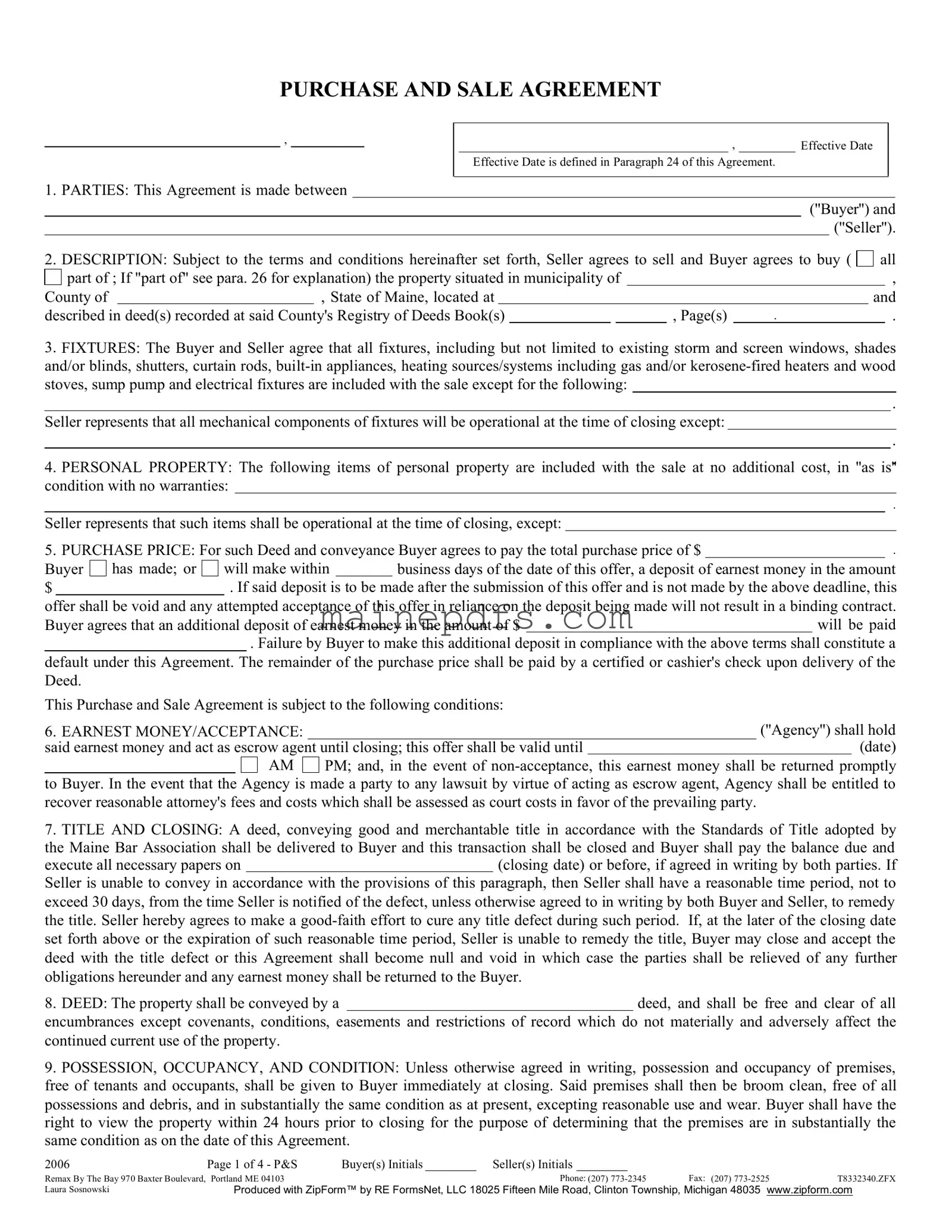

An Earnest Money Agreement, much like the Maine Sale Agreement, involves the buyer depositing earnest money as a sign of good faith that they intend to proceed with the property purchase. This document outlines the conditions under which the deposit is held, specifying how the earnest money is to be disbursed upon the fulfillment of the agreement or returned if the transaction does not complete, echoing the provisions found in the Maine Sale Agreement regarding earnest money and contractual obligations.

A Deed of Trust represents another document with parallels to the Maine Sale Agreement, especially in the mechanism of facilitating real estate transactions. While a Deed of Trust involves a trustee holding the property's title until a borrower pays off their loan, the Sale Agreement directly deals with the conditions under which property ownership is transferred from seller to buyer. Both documents are integral in real estate transactions, ensuring clear terms and protection for all parties involved.

A Property Disclosure Statement, although not a contract like the Maine Sale Agreement, serves a crucial role in real estate transactions by providing detailed information about the property's condition. This form requires sellers to disclose known defects and conditions that could affect the property’s value or desirability, similar to the disclosure obligations outlined in the Sale Agreement. While the Sale Agreement contains broader terms of sale, the Property Disclosure Statement zeroes in on the property's physical condition.

An Option Agreement in real estate is related closely to the Maine Sale Agreement in creating an arrangement where the buyer gains the right, but not the obligation, to purchase property within a specified period. The similarity lies in their focus on specific terms and conditions under which a sale might occur, although an Option Agreement provides a path to the sale rather than finalizing it, underscoring the preparatory phase before reaching a Sale Agreement.

The Buyer’s Agent Agreement is akin to the Maine Sale Agreement in that it establishes a formal relationship between a buyer and a real estate agent, similar to how the sale agreement establishes the terms between buyer and seller. This document outlines the responsibilities of the agent to the buyer, including efforts to identify properties and negotiate purchase terms, indirectly supporting the process that culminates in a Sale Agreement by ensuring the buyer is well-represented.

A Home Warranty Agreement, distinct yet complementary to the Maine Sale Agreement, offers the buyer warranty coverage for home systems and appliances. This agreement comes into play post-sale, providing protection against future problems that are not covered in the Sale Agreement itself. While the Sale Agreement finalizes the terms of the property transaction, the Home Warranty Agreement extends assurances beyond the closing date regarding the condition and functionality of the property’s integral components.

The Contingency Removal Form closely aligns with the Maine Sale Agreement by addressing specific conditions that must be met before the real estate transaction can proceed to closing. This document is crucial for both parties to move forward with confidence, ensuring that agreed-upon conditions, such as inspections, financing, and appraisals, are satisfied. It exemplifies the procedural steps necessary for fulfilling the terms of the Sale Agreement, emphasizing the transaction’s conditional nature.

A Loan Agreement, while primarily financial and not directly a vehicle for transferring property like the Maine Sale Agreement, plays an essential role in many real estate transactions by specifying the terms under which a lender provides the buyer with funds to purchase property. Similar to the Sale Agreement, it contains detailed terms and conditions, including repayment obligations. The completion of such financial arrangements often directly enables the execution of the Sale Agreement, highlighting their interconnected roles in property transactions.