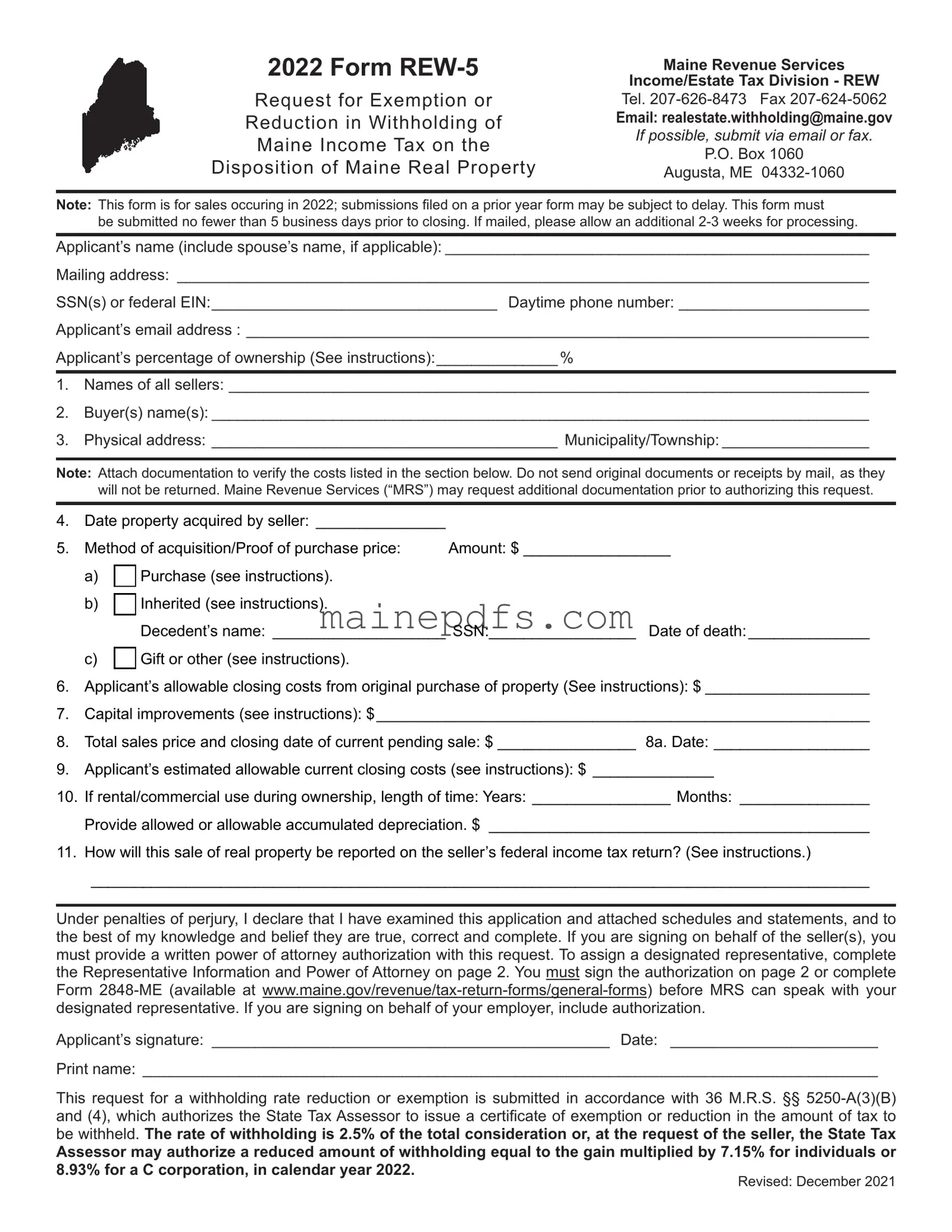

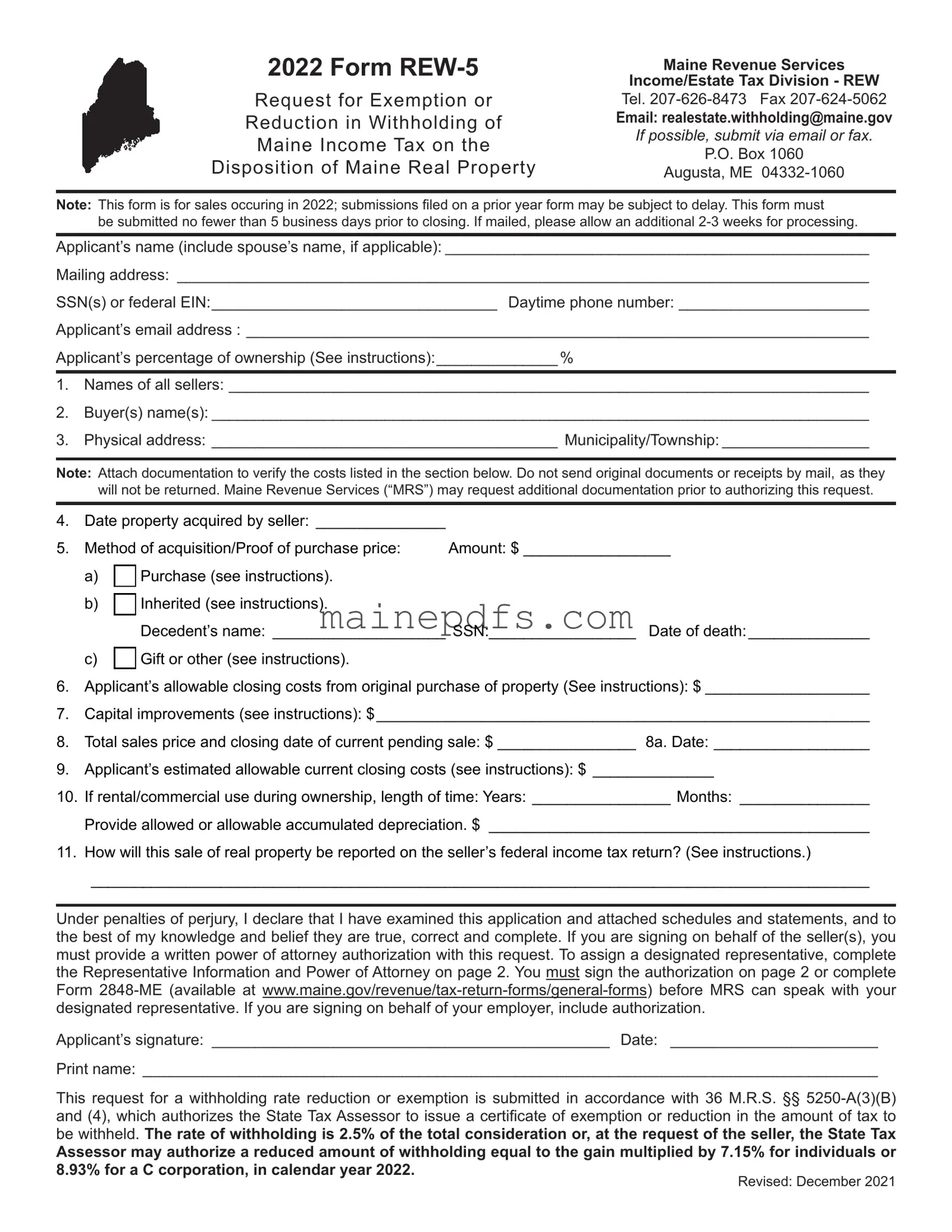

Note: This form is for sales occuring in 2022; submissions filed on a prior year form may be subject to delay. This form must

be submitted no fewer than 5 business days prior to closing. If mailed, please allow an additional 2-3 weeks for processing.

Applicant’s name (include spouse’s name, if applicable): _________________________________________________

Mailing address: ________________________________________________________________________________

SSN(s) or federal EIN:_________________________________ Daytime phone number: ______________________

Applicant’s email address : ________________________________________________________________________

Applicant’s percentage of ownership (See instructions):______________ %

1.Names of all sellers: __________________________________________________________________________

2.Buyer(s) name(s): ____________________________________________________________________________

3.Physical address: ________________________________________ Municipality/Township: _________________

Note: Attach documentation to verify the costs listed in the section below. Do not send original documents or receipts by mail, as they will not be returned. Maine Revenue Services (“MRS”) may request additional documentation prior to authorizing this request.

4. |

Date property acquired by seller: _______________ |

|

5. |

Method of acquisition/Proof of purchase price: |

Amount: $ _________________ |

|

a) |

|

Purchase (see instructions). |

|

|

|

|

|

|

|

|

|

|

b) |

|

Inherited (see instructions). |

|

|

|

|

Decedent’s name: ____________________ SSN:_________________ Date of death:______________ |

c)

Gift or other (see instructions).

Gift or other (see instructions).

6.Applicant’s allowable closing costs from original purchase of property (See instructions): $ ___________________

7.Capital improvements (see instructions): $_________________________________________________________

8.Total sales price and closing date of current pending sale: $ ________________ 8a. Date: __________________

9.Applicant’s estimated allowable current closing costs (see instructions): $ ______________

10.If rental/commercial use during ownership, length of time: Years: ________________ Months: _______________

Provide allowed or allowable accumulated depreciation. $ ____________________________________________

11.How will this sale of real property be reported on the seller’s federal income tax return? (See instructions.)

__________________________________________________________________________________________

Under penalties of perjury, I declare that I have examined this application and attached schedules and statements, and to the best of my knowledge and belief they are true, correct and complete. If you are signing on behalf of the seller(s), you must provide a written power of attorney authorization with this request. To assign a designated representative, complete the Representative Information and Power of Attorney on page 2. You must sign the authorization on page 2 or complete Form 2848-ME (available at www.maine.gov/revenue/tax-return-forms/general-forms) before MRS can speak with your designated representative. If you are signing on behalf of your employer, include authorization.

Applicant’s signature: ______________________________________________ Date: ________________________

Print name: _____________________________________________________________________________________

This request for a withholding rate reduction or exemption is submitted in accordance with 36 M.R.S. §§ 5250-A(3)(B) and (4), which authorizes the State Tax Assessor to issue a certificate of exemption or reduction in the amount of tax to

be withheld. The rate of withholding is 2.5% of the total consideration or, at the request of the seller, the State Tax

Assessor may authorize a reduced amount of withholding equal to the gain multiplied by 7.15% for individuals or 8.93% for a C corporation, in calendar year 2022.

Gift or other (see instructions).

Gift or other (see instructions).