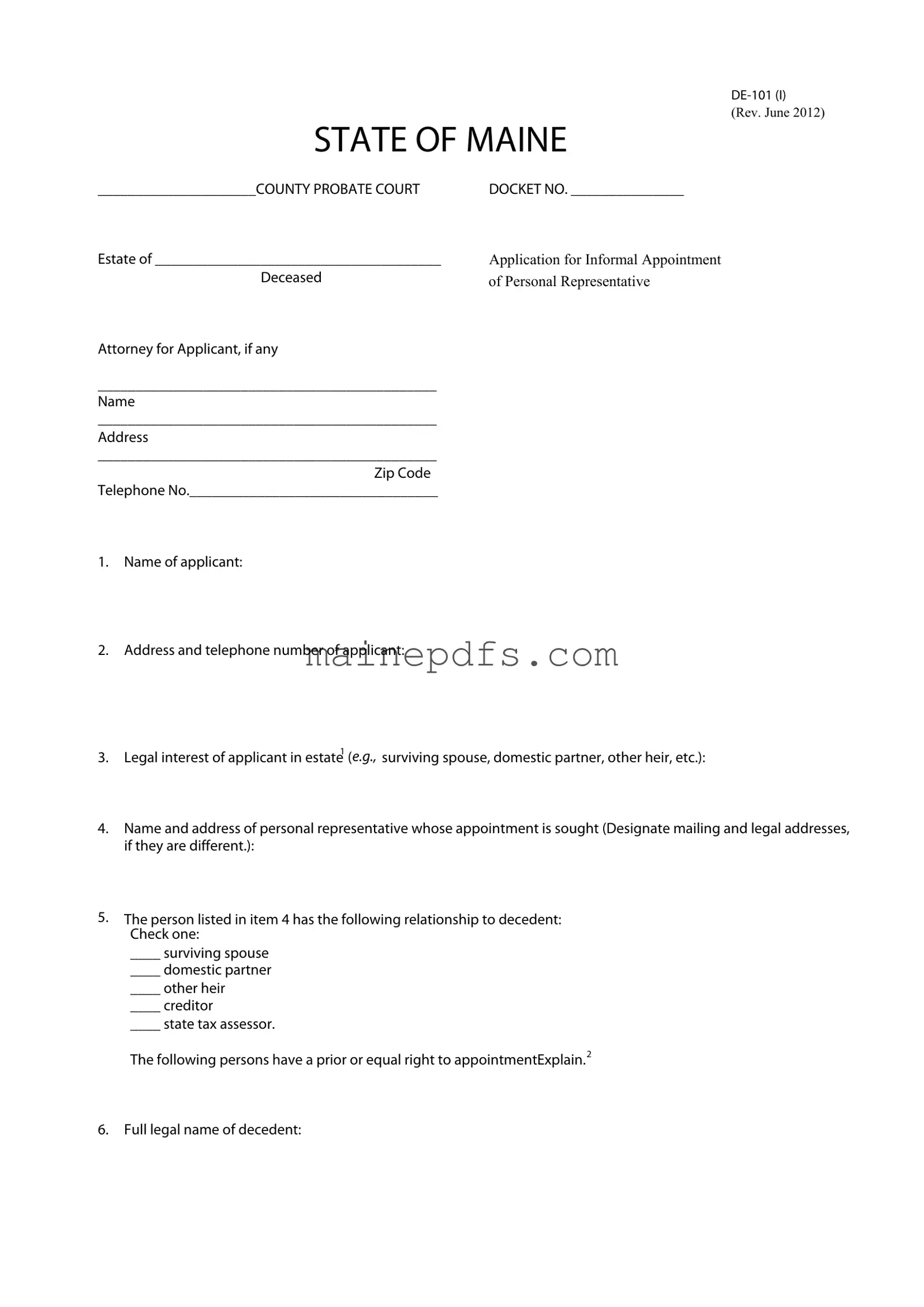

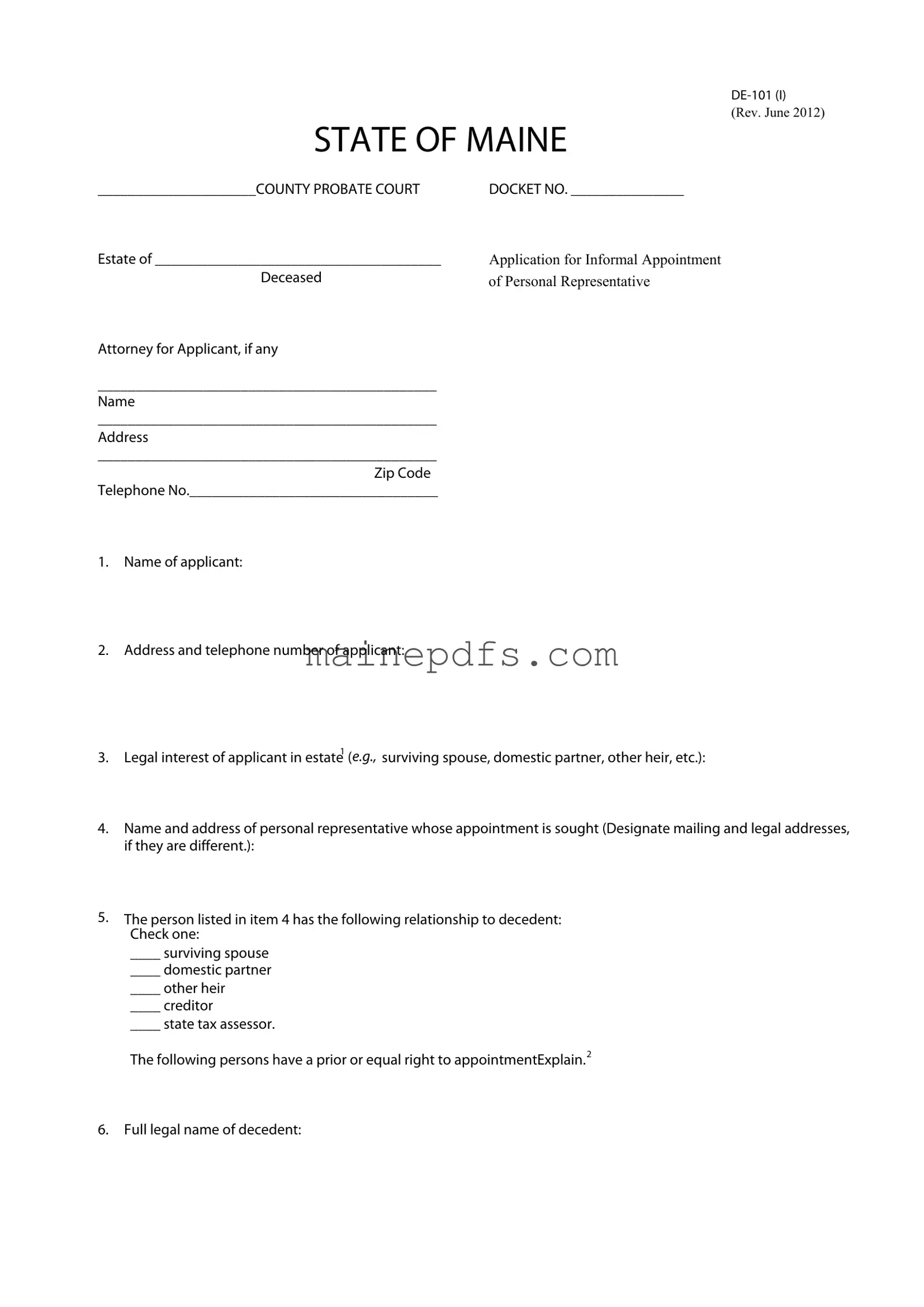

DE-101 (I)

(Rev. June 2012)

STATE OF MAINE

_____________________COUNTY PROBATE COURT |

DOCKET NO. _______________ |

Estate of ______________________________________ |

Application for Informal Appointment |

Deceased |

of Personal Representative |

|

Attorney for Applicant, if any |

|

_____________________________________________ |

|

Name |

|

_____________________________________________ |

|

Address |

|

_____________________________________________ |

|

Zip Code |

|

Telephone No._________________________________ |

|

1.Name of applicant:

2.Address and telephone number of applicant:

3.Legal interest of applicant in estate1 (E.G., surviving spouse, domestic partner, other heir, etc.):

4.Name and address of personal representative whose appointment is sought (Designate mailing and legal addresses, if they are different.):

5.The person listed in item 4 has the following relationship to decedent:

Check one:

____ surviving spouse

____ domestic partner

____ other heir

____ creditor

____ state tax assessor.

The following persons have a prior or equal right to appointment:Explain.2

6.Full legal name of decedent:

DE-101 (I)

(Rev.June 2012) Page 2 of 4

7.Date of decedent’s death:

8.Date of decedent’s birth: 3

9.Domicile of decedent at date of death:

10a. Names and addresses of spouse, registered domestic partner, children and other heirs: 4

|

|

Date of Birth 5 |

Relationship to |

Name |

Address |

if Under 18 |

decedent: |

10b. Is there a domestic partner (non-registered)?:YES ____ NO ____ If yes, give name and address. 6

11.Does the probate estate contain real estate in Maine? YES ____ NO ____. If yes, list each municipality and county in which such real estate is located. NOTE: Do not list jointly held property which passes by survivorship.

12.Was decedent domiciled outside of Maine at date of death? YES ____ NO ____. If yes, identify here decedent’s property which was, at the time of decedent’s death, or has since then been located in this county, and state whether probate proceedings have been commenced elsewhere with respect to this estate7 .

13.Has a personal representative of the decedent been appointed by any court prior to this date whose appointment has not been terminated? YES ____ NO ____. If yes, state that person’s name and address.

DE-101 (I)

(Rev.June 2012) Page 3 of 4

14. Did decedent die more than three years before the date of this petition? YES ____ NO ____. If yes, state here the

8

circumstances which authorize commencing this proceeding.

15. Has the applicant received a demand for notice or is the applicant aware of any demand for notice of any probate or

appointment proceeding concerning the decedent that may have been filed in this state or elsewhere?9 YES ____ NO ____. If yes, include name and address of person demanding notice.

16. I request the Court to give notice of this filing to the heirs listed in item 10a and 10b and if the decedent was 55

10

years of age or older, to the Department of Health and Human Services and to the following other persons:

17. Check if desired:

_____ Pursuant to Rule 80B(a), I request the register to publish notice to creditors. 11

18. Check one:

____ No bond is required. 12

____ A personal representative’s bond is required and is attached.

____ An estate tax bond is required and is attached. 13

19. Check (a) or (b):

____ (a) I know of an unrevoked testamentary instrument relating to property in this estate, and I have attached a

statement setting forth why that instrument is not being probated.14

____ (b) After exercise of reasonable diligence, I am unaware of any unrevoked testamentary instrument relating to

property having a situs in this state. 15

20. Verification:

Under penalty of perjury, I, the undersigned applicant, state as follows:

(a)All of the foregoing facts and statements are complete and accurate as far as I know or am informed.

(b)I understand that by executing this verification I submit personally to the jurisdiction of this court in any proceeding for relief from fraud relating to this application or for perjury that may be instituted against me16.

§ 3-203 (c).

DE-101 (I)

(Rev. June 2012)

Page 4 of 4

21.I request the register to make the findings and determinations required by 18-A MRSA § 3-308 and to appoint as personal representative the person listed in item 4.

Dated ___________________________ |

________________________________________________ |

|

|

|

Applicant or Attorney |

Fees due upon filing: |

|

|

Filing Fee $_____________ |

Mailing Notices $_______ |

Notice to Creditors $______________ |

|

|

|

Surcharge $ _ |

___________ |

|

Abstracts $_____________ |

Other $______________ |

Special Instructions

People with priority for appointment equal to or greater than the person whose appointment is sought may renounce or concur by

signing here or by a separate writing or by filing a Renunciation/Nomination form (Probate Court Form DE-407).“I hereby renounce my right to appointment or concur in the appointment sought or both as required by law.” See 18-A

MRSA |

____________________________________________ |

____________________________________________ |

____________________________________________ |

____________________________________________ |

____________________________________________ |

____________________________________________ |

If a person wishes to renounce and simultaneously to nominate a substitute personal representative to take the priority of the renouncing party, the renouncing party may accomplish this by being the applicant on this form or by separate written notice.

1 All statutory references are to Title 18-A MRSA. See § 1-201 (20).

2See § 3-203. In general, the surviving spouse has first priority; heirs come before creditors. All heirs have equal rights of priority under § 3-203.

See below for special instructions.

3If exact birthdate is unknown, give age in years of decedent at date of death.

4See § 1-201 (17). Relationship of all heirs to decedent should be stated and explained: E.G., “spouse,” or “nephew, son of (name) predeceased brother”.

5Age is required by law if person listed is a minor. If person listed is an adult (i.e. has attained 18 years of age) the letter “A” may be inserted in

place of the person’s age. See § 3-301 (a) (1) (ii).

6See § 1-201 (10-A)

7See § 3-201.

8See § 3-108.

9See § 3-301 (a) (1) (v).

10This request, accompanied by proper information and fees, fulfills the moving party’s duty to give notice pursuant to §§ 3-306, 3-310. Applicant should list all persons to whom notice must be sent, including persons who have filed a demand for notice pursuant§to3-204. Include address for any person whose address does not appear elsewhere in this form.

11If this is not checked, the personal representative must publish his own notice.

12See § 3-603.

13See 36 MRSA § 4079

14See § 3-301 (a) (4).

15See § 1-301.

16See §§ 1-310 and 3-301 (b).

I certify that no alteration has been made to the official form as most recently approved and promulgated by the Supreme Judicial Court. I also certify that I have met the standards under M.R.Prob.P. 84(b).

_____________________________________________ |

_____________________________________________ |

Preparer Signature |

Typed or Printed Name of Preparer |

MARP |