Download Maine Afppgmc Template in PDF

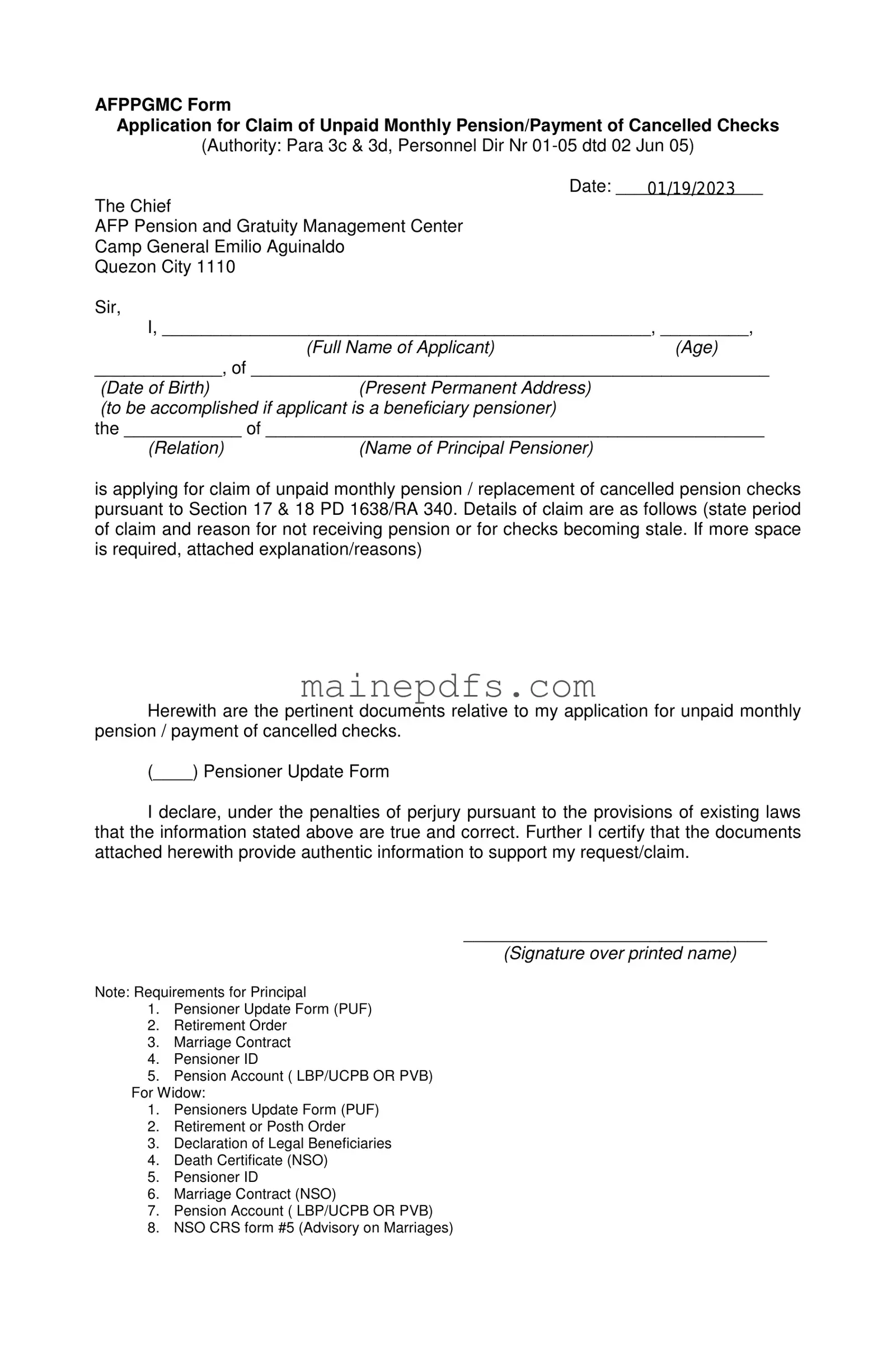

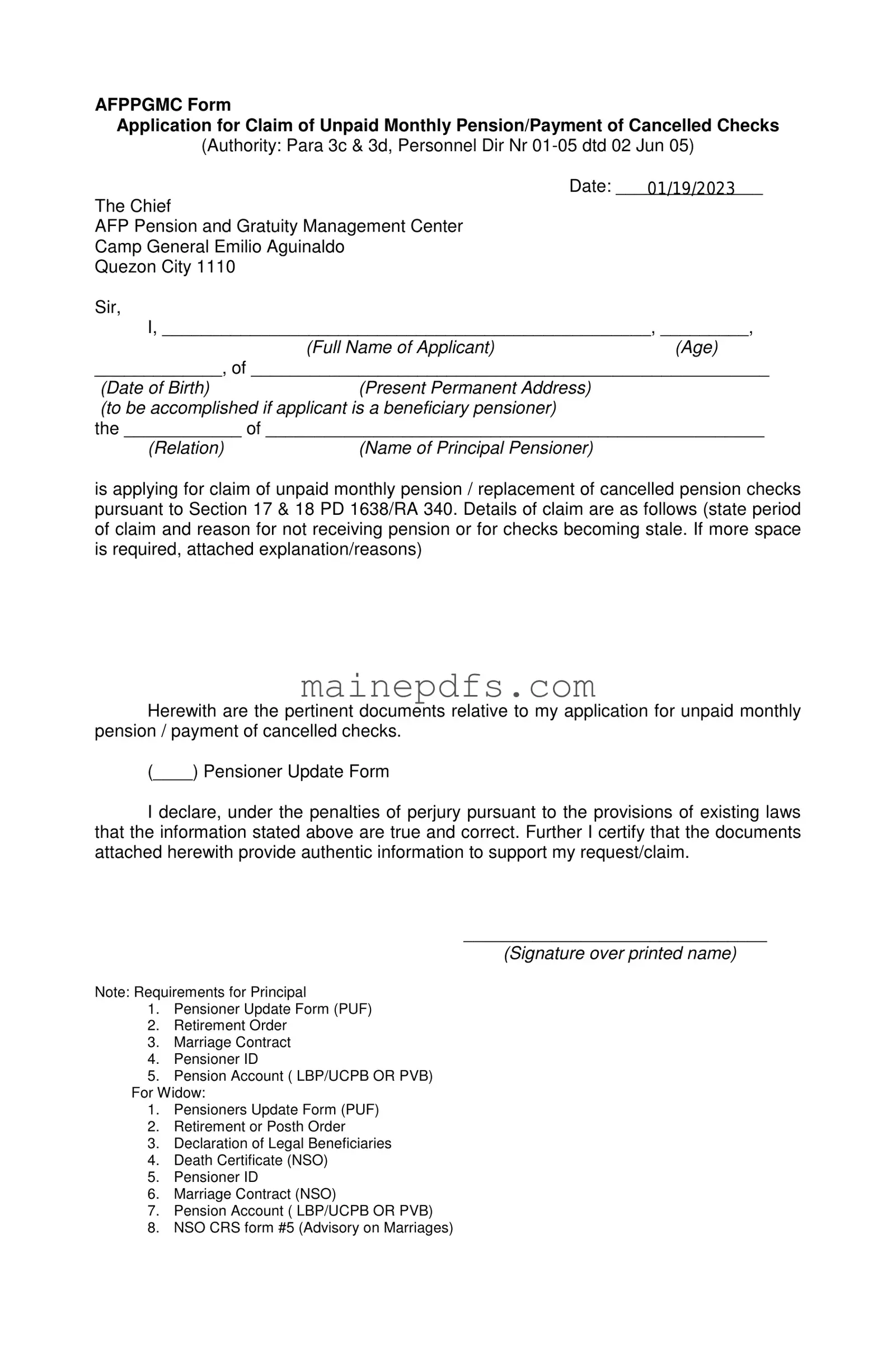

The Maine AFPPGMC form serves a crucial purpose, facilitating applications for unpaid monthly pensions or requesting payment for cancelled checks. This document, under the authority of Paragraphs 3c and 3d from Personnel Directive Number 01-05 dated June 2, 2005, is designed for individuals or beneficiaries seeking redress for pension-related issues. Ready to ensure your financial rights are acknowledged? Click the button below to fill out the form confidently.

Make My Document Online

Download Maine Afppgmc Template in PDF

Make My Document Online

Make My Document Online

or

Click for PDF Form

A few steps left to finish this form

Finish Maine Afppgmc online — no paper, no scanner needed.