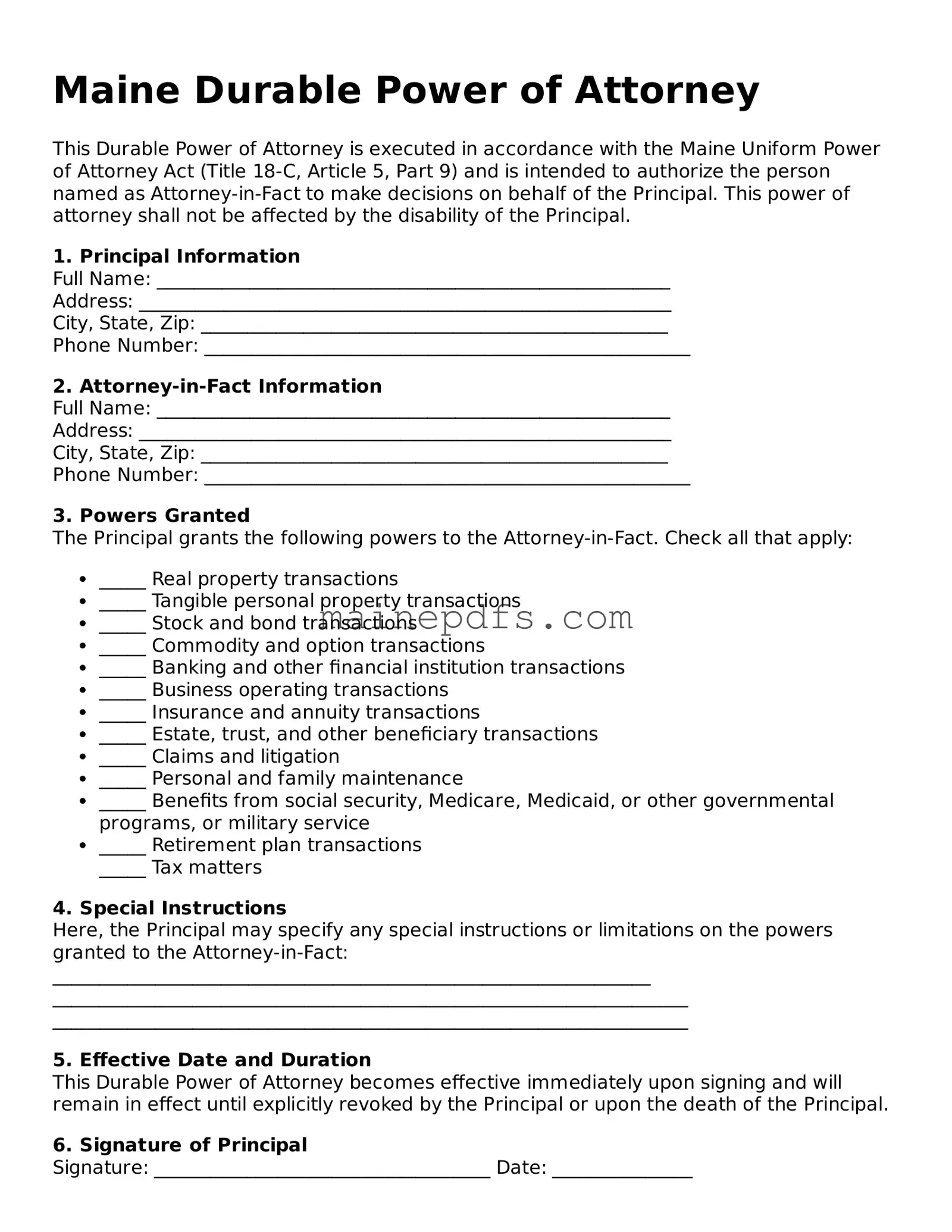

Maine Durable Power of Attorney

This Durable Power of Attorney is executed in accordance with the Maine Uniform Power of Attorney Act (Title 18-C, Article 5, Part 9) and is intended to authorize the person named as Attorney-in-Fact to make decisions on behalf of the Principal. This power of attorney shall not be affected by the disability of the Principal.

1. Principal Information

Full Name: _______________________________________________________

Address: _________________________________________________________

City, State, Zip: __________________________________________________

Phone Number: ____________________________________________________

2. Attorney-in-Fact Information

Full Name: _______________________________________________________

Address: _________________________________________________________

City, State, Zip: __________________________________________________

Phone Number: ____________________________________________________

3. Powers Granted

The Principal grants the following powers to the Attorney-in-Fact. Check all that apply:

- _____ Real property transactions

- _____ Tangible personal property transactions

- _____ Stock and bond transactions

- _____ Commodity and option transactions

- _____ Banking and other financial institution transactions

- _____ Business operating transactions

- _____ Insurance and annuity transactions

- _____ Estate, trust, and other beneficiary transactions

- _____ Claims and litigation

- _____ Personal and family maintenance

- _____ Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- _____ Retirement plan transactions

_____ Tax matters

4. Special Instructions

Here, the Principal may specify any special instructions or limitations on the powers granted to the Attorney-in-Fact:

________________________________________________________________

____________________________________________________________________

____________________________________________________________________

5. Effective Date and Duration

This Durable Power of Attorney becomes effective immediately upon signing and will remain in effect until explicitly revoked by the Principal or upon the death of the Principal.

6. Signature of Principal

Signature: ____________________________________ Date: _______________

Print Name: ___________________________________

7. Signature of Attorney-in-Fact

Signature: ____________________________________ Date: _______________

Print Name: ___________________________________

8. Acknowledgment by Notary Public

This section to be completed by a Notary Public, affirming the identity of the Principal and the Attorney-in-Fact and the voluntary signing of this document by both parties.

State of Maine)

County of __________________)

Subscribed and sworn to (or affirmed) before me this __________ day of ________________, 20____, by _______________________________, the Principal, and _______________________________, the Attorney-in-Fact.

___________________________________

Notary Public

My Commission Expires: _______________