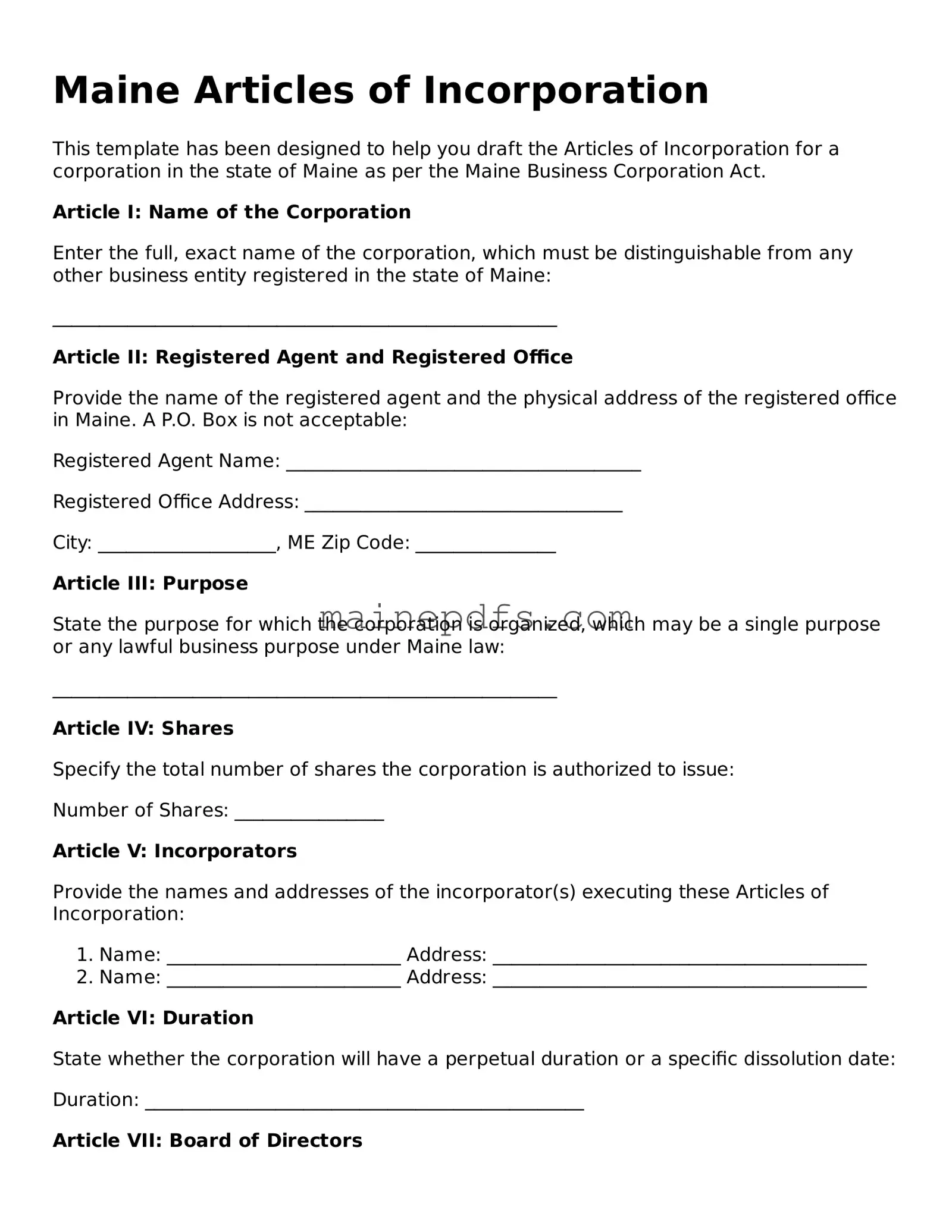

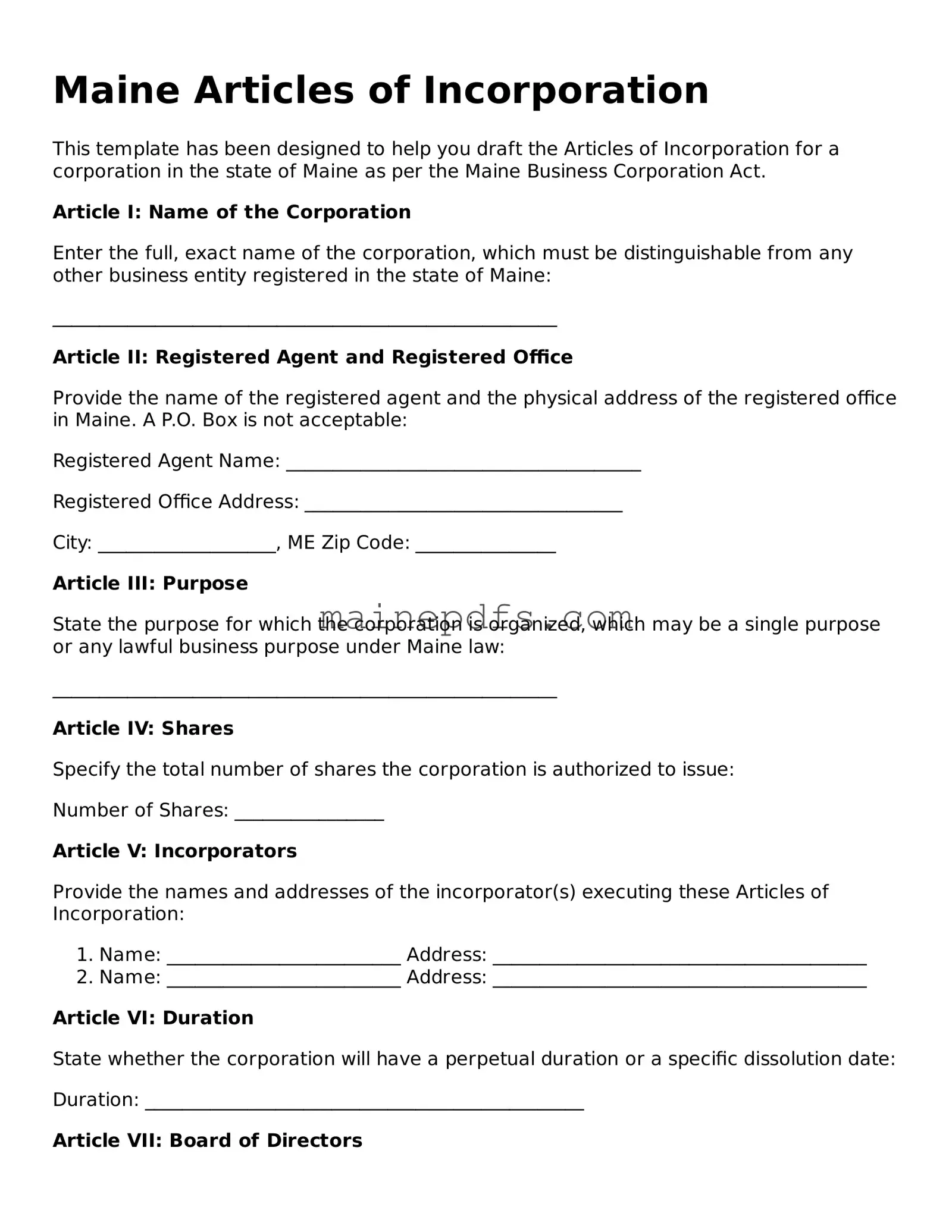

Attorney-Approved Maine Articles of Incorporation Template

The Maine Articles of Incorporation form serves as a critical document for establishing a corporation within the state. It provides a legal foundation for the corporation, detailing essential aspects such as the corporation's name, purpose, and the information of its incorporators. For those looking to form a corporation in Maine, completing this form is a pivotal first step. Click the button below to start filling out your form.

Make My Document Online

Attorney-Approved Maine Articles of Incorporation Template

Make My Document Online

Make My Document Online

or

Click for PDF Form

A few steps left to finish this form

Finish Articles of Incorporation online — no paper, no scanner needed.